Direct and indirect engagement

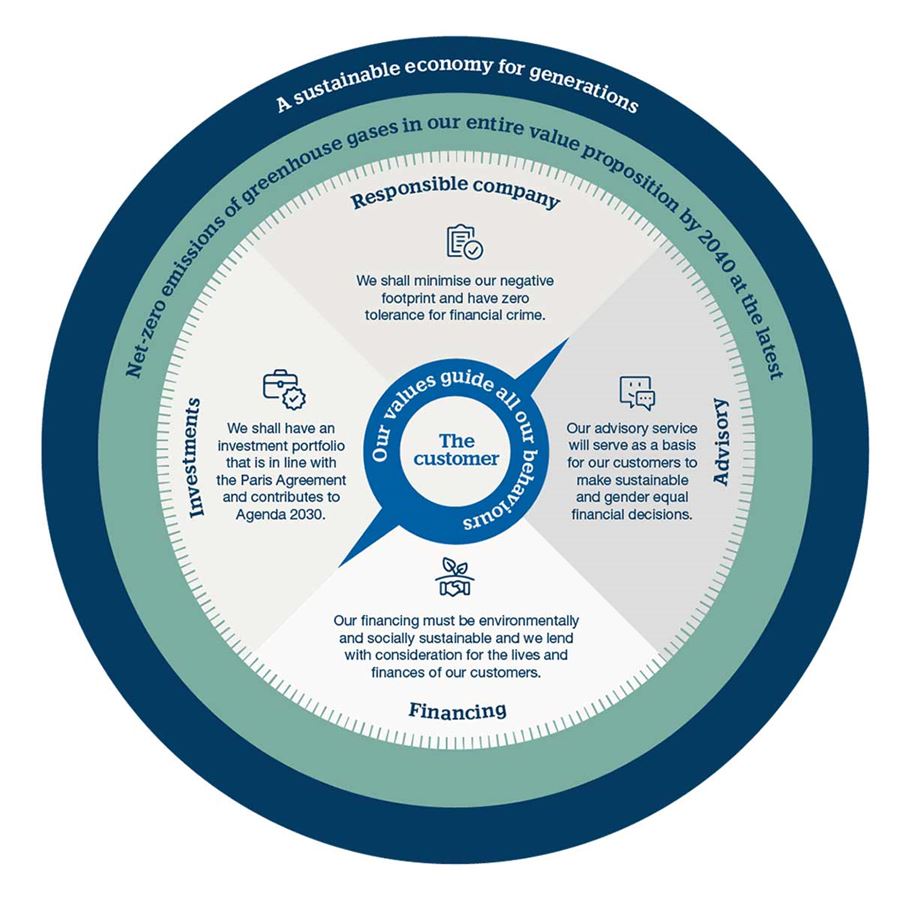

A well-run bank that acts sustainably and responsibly has a positive impact on the economy in general. This applies to direct economic effects, such as paying corporate tax, as well as indirect effects. For example, the conditions under which the Bank lends money can make a huge difference, to both the individual and society.

In all markets it serves, Handelsbanken finances growth and helps increase employment by providing financing for companies. For example, Handelsbanken is the largest corporate lender in Sweden, and more than one-fifth of household mortgages in Sweden are financed by the Handelsbanken Group.

Banking operations in themselves have a relatively minor direct impact on the environment and climate, but striving to constantly reduce the Bank’s own impact remains important. Looking for ways to improve energy efficiency, reducing paper consumption and cutting back on travel by air and car – focusing instead on solutions for remote meetings – help to reduce the Bank’s direct negative impact. Digital solutions also help the Bank and customers to reduce their respective climate footprints.

A sustainable society requires a robust financial system that cannot be abused. For this reason, the fight against money laundering and terrorist financing is a key component of the 2030 Agenda and the SDGs. Handelsbanken regards work to prevent financial crime as a fundamental principle for secure, sound banking operations.